Integrated Risk Management

Integrated Risk Management System

Integrated Risk Management Policy

SK Gas operates an integrated risk management framework to effectively manage and respond to potential risks. The Board of Directors oversees and manages potential integrated risks at the board level, and a dedicated independent risk management organization and departments responsible for each risk item carry out risk management activities.

Company-Wide Risk Management Regulations

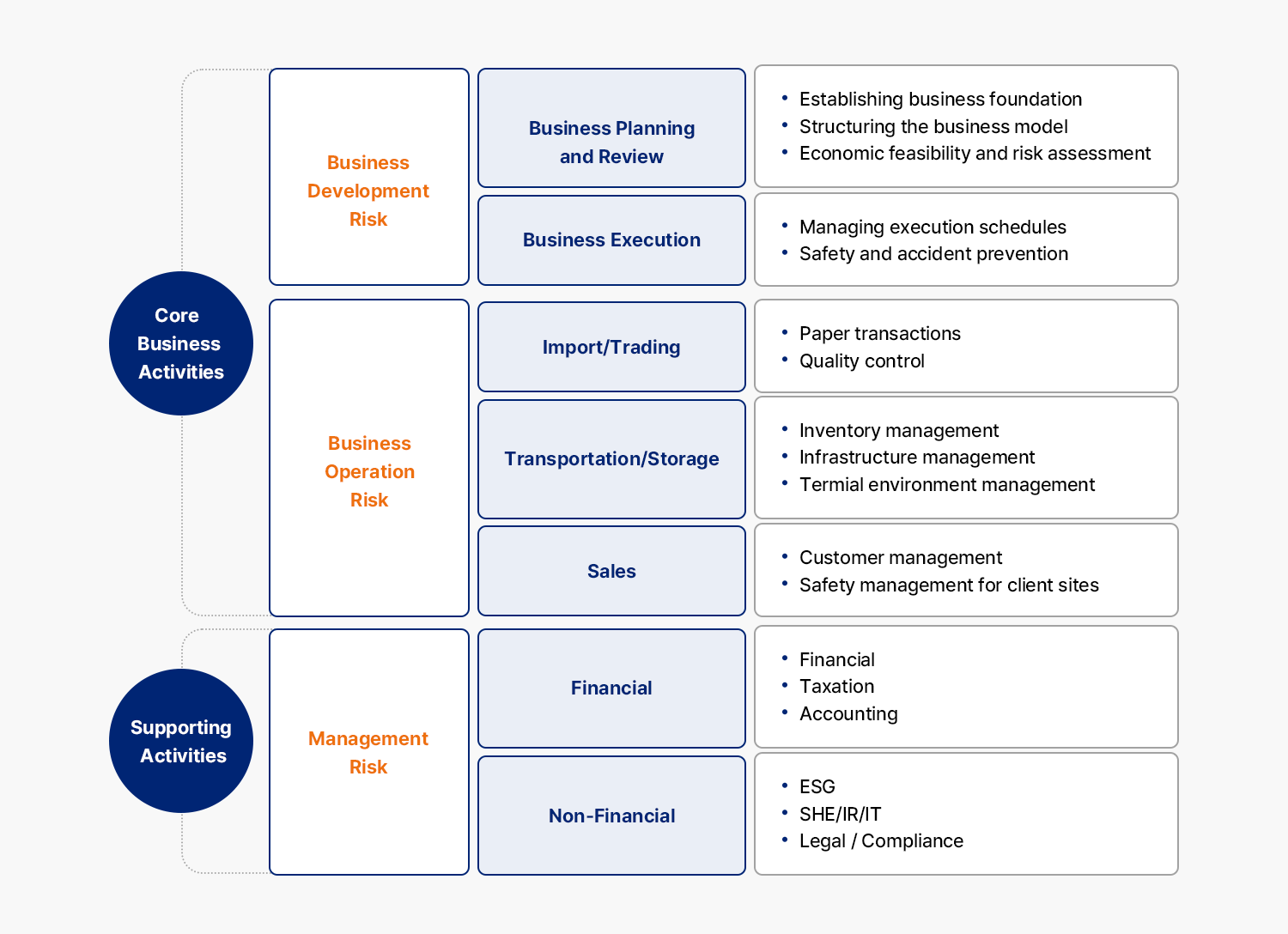

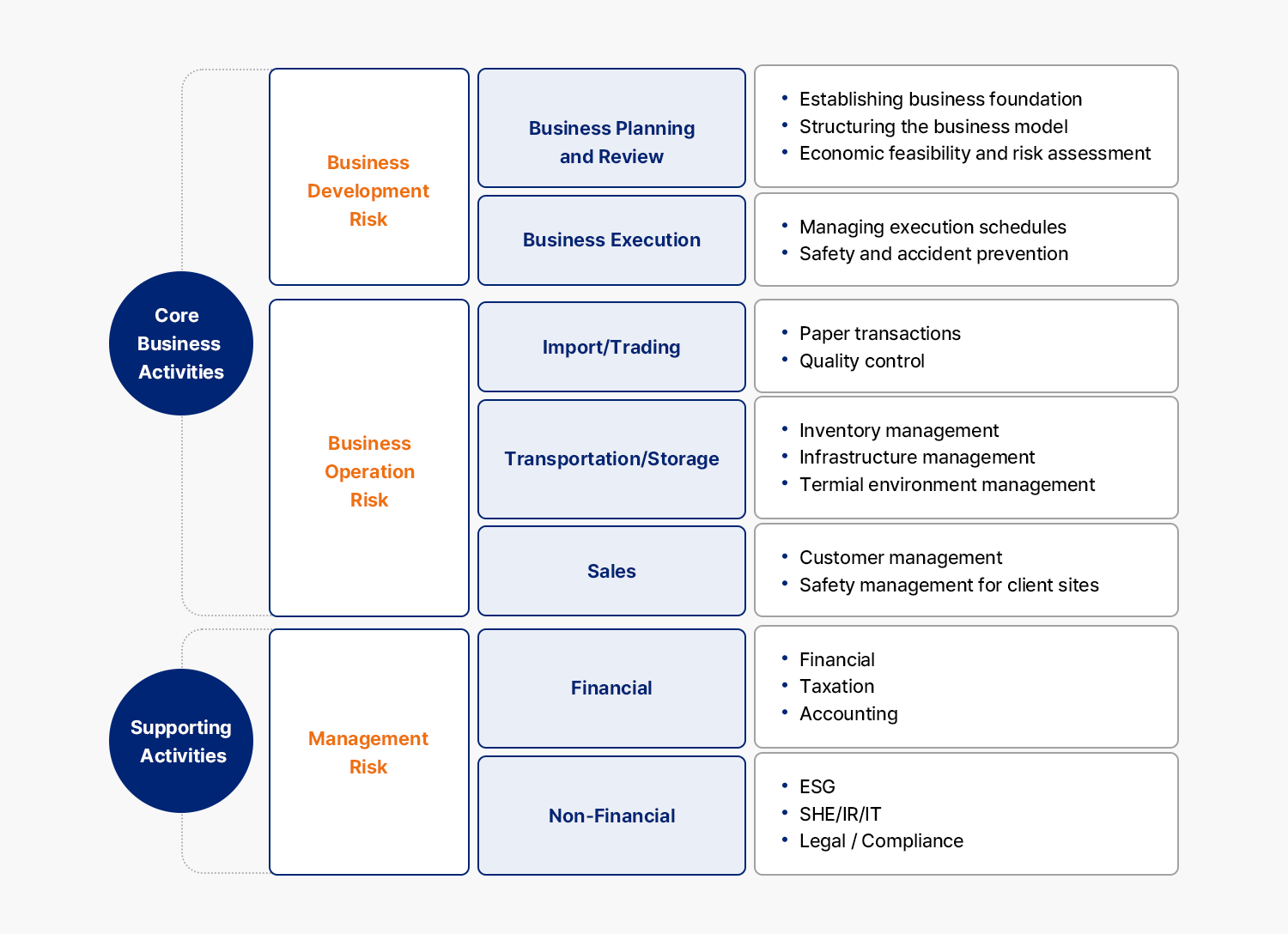

SK Gas operates company-wide risk management regulations to comprehensively and systematically manage various risks that may arise in the company's management processes. We define risk as the potential for losses in the company's financial performance, corporate value, reputation, etc., due to various uncertainties that may occur in the company's business activities. Furthermore, we systematically manage risks by categorizing them into business development risks, business operation risks, and management control risks.

Definition of Risks

Governance

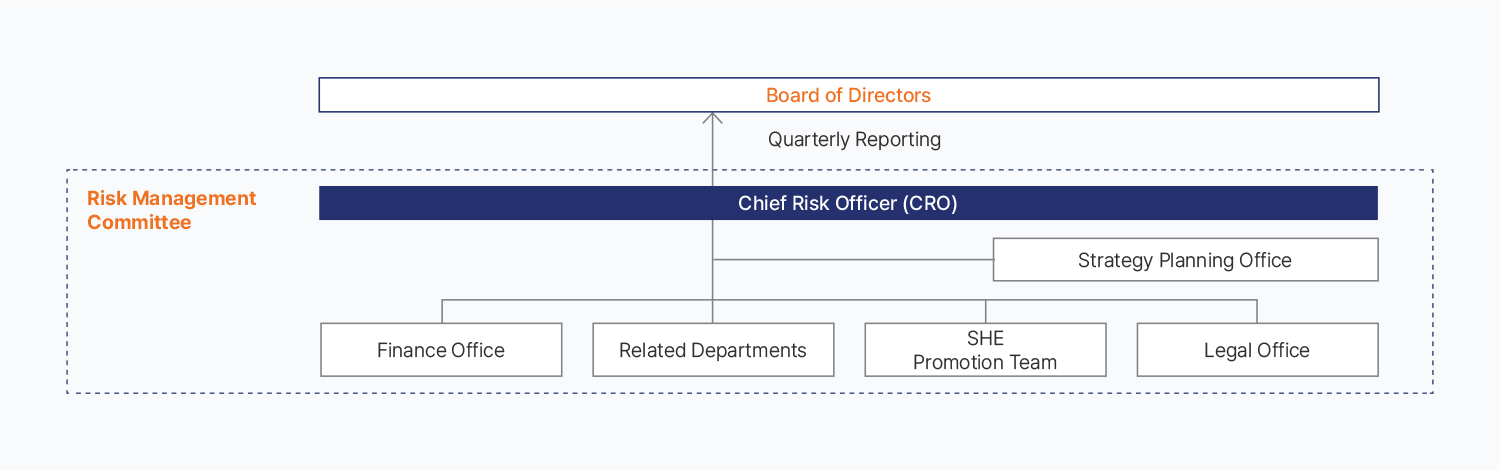

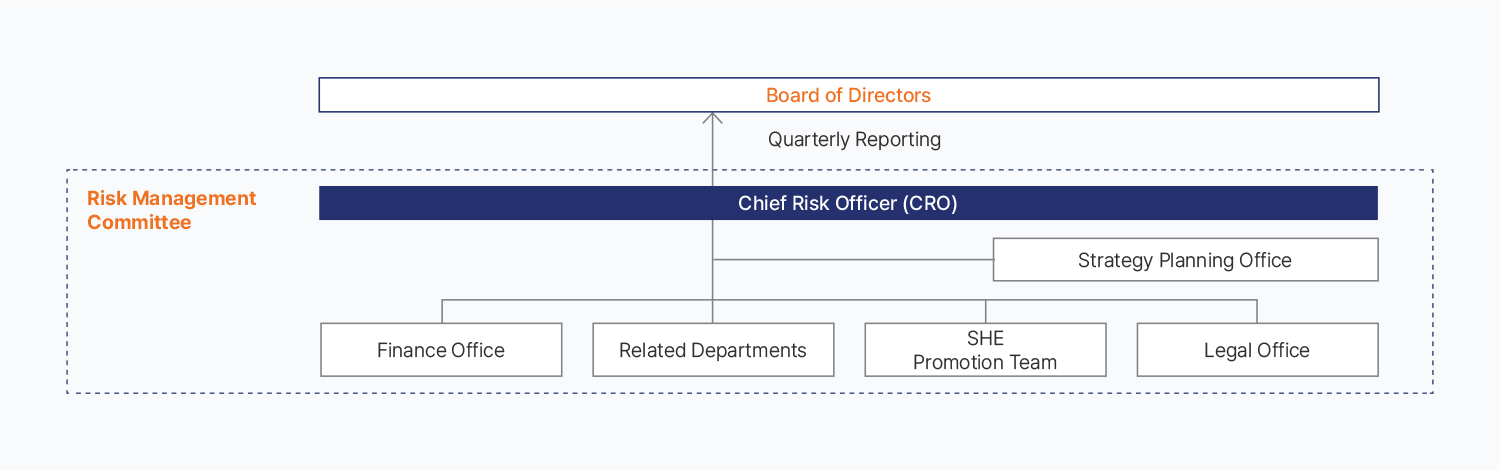

The Risk Management Committee

The Risk Management Committee plays a role in comprehensively managing various risks dispersed across different departments. It regularly reviews potential risks across the entire company and has been reporting the results of these reviews to the Board of Directors.

Chief Risk Officer (CRO)

The Chief Risk Officer (CRO), who is the highest risk management officer of the Risk Management Committee, reports the results of risk reviews to the Board of Directors on a quarterly basis and ad hoc when significant issues arise.

Dedicated Company-Wide Risk Management Organization

The Strategic Planning Office serves as the dedicated company-wide risk management organization, supporting the duties of the Chief Risk Officer. It regularly reviews the status of company-wide risk management, verifies detailed information, and supports the execution of risk management, including reporting review results.

Risk Item-Specific Management Organizations

Each risk item-specific management organization regularly monitors potential risks using relevant indicators. In particular, executives in charge of each risk item serve as Risk Management Committee members, managing and coordinating risks that may arise within their respective departments. Risk Management Committee members can immediately report the management status to the Risk Management Committee when significant issues occur.

Integrated Risk Management Strategy

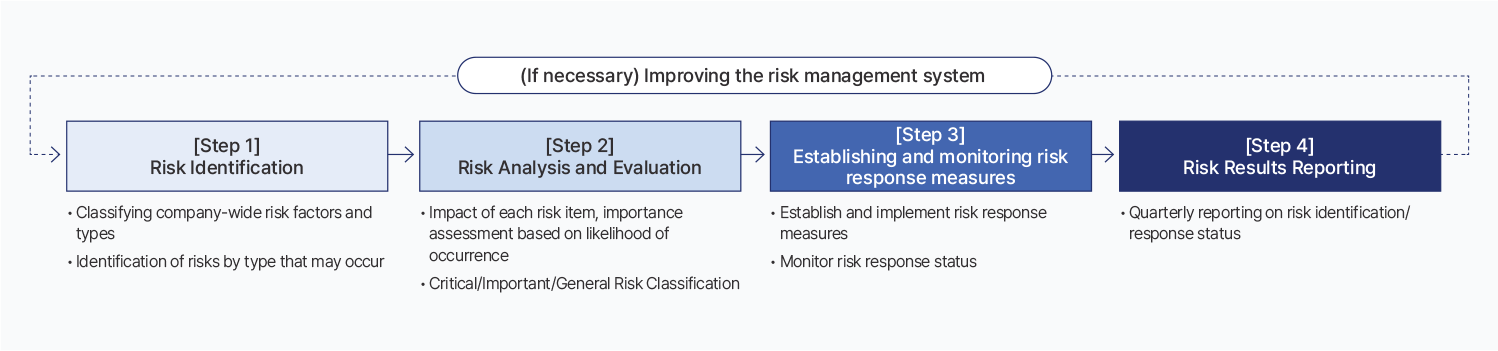

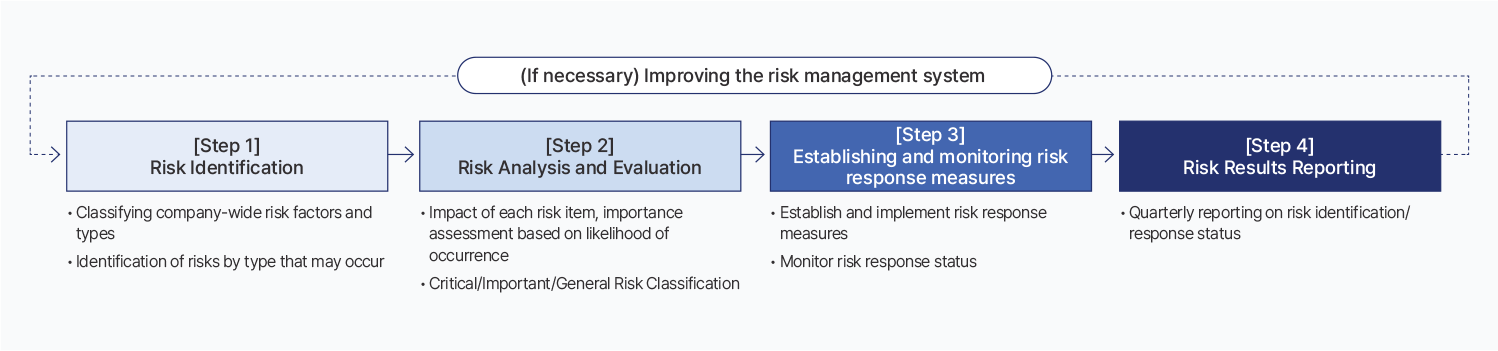

Integrated Risk Management Process

SK Gas operates a four-step risk management process to manage financial and non-financial risks that could impact the company's management activities. SK Gas reports the results of company-wide risk assessments and key issues to the Board of Directors every quarter. This report includes the importance and occurrence status of each risk item, as well as detailed key issues. Through its company-wide risk management system, SK Gas identifies and assesses key risks with high importance, and then establishes, implements, and monitors response strategies for these risks.

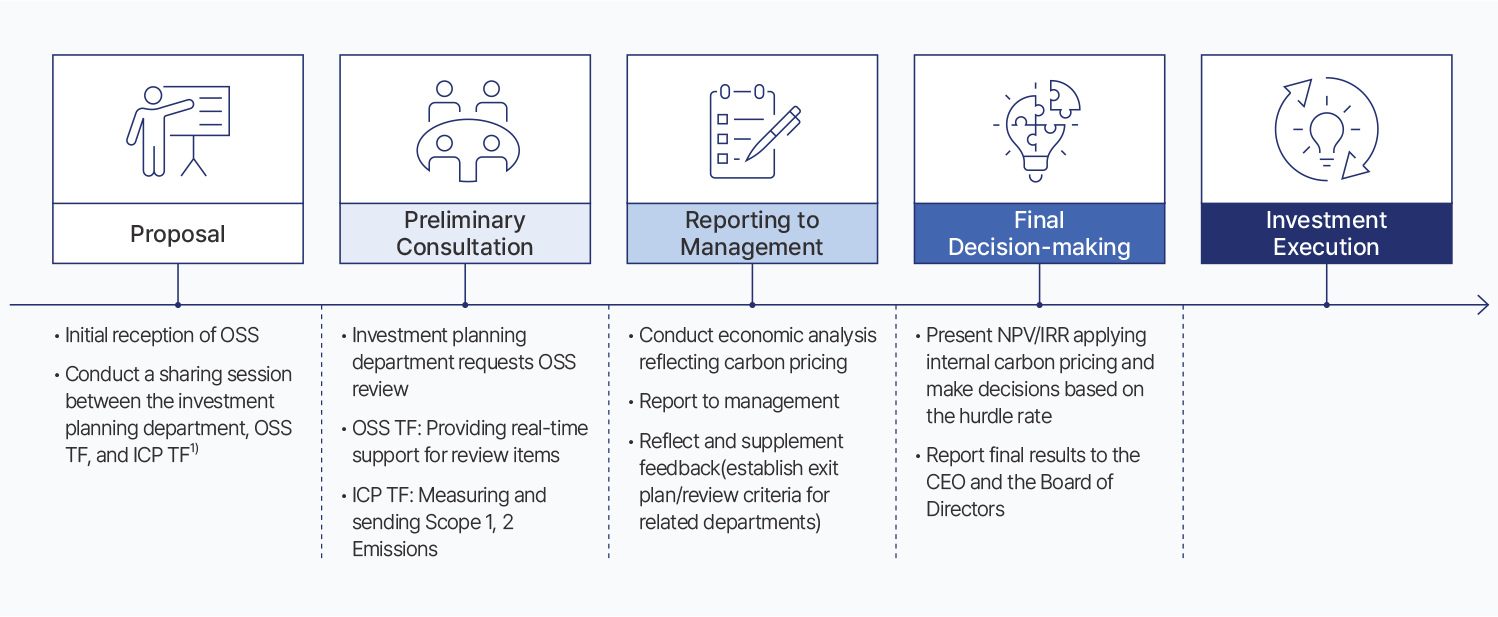

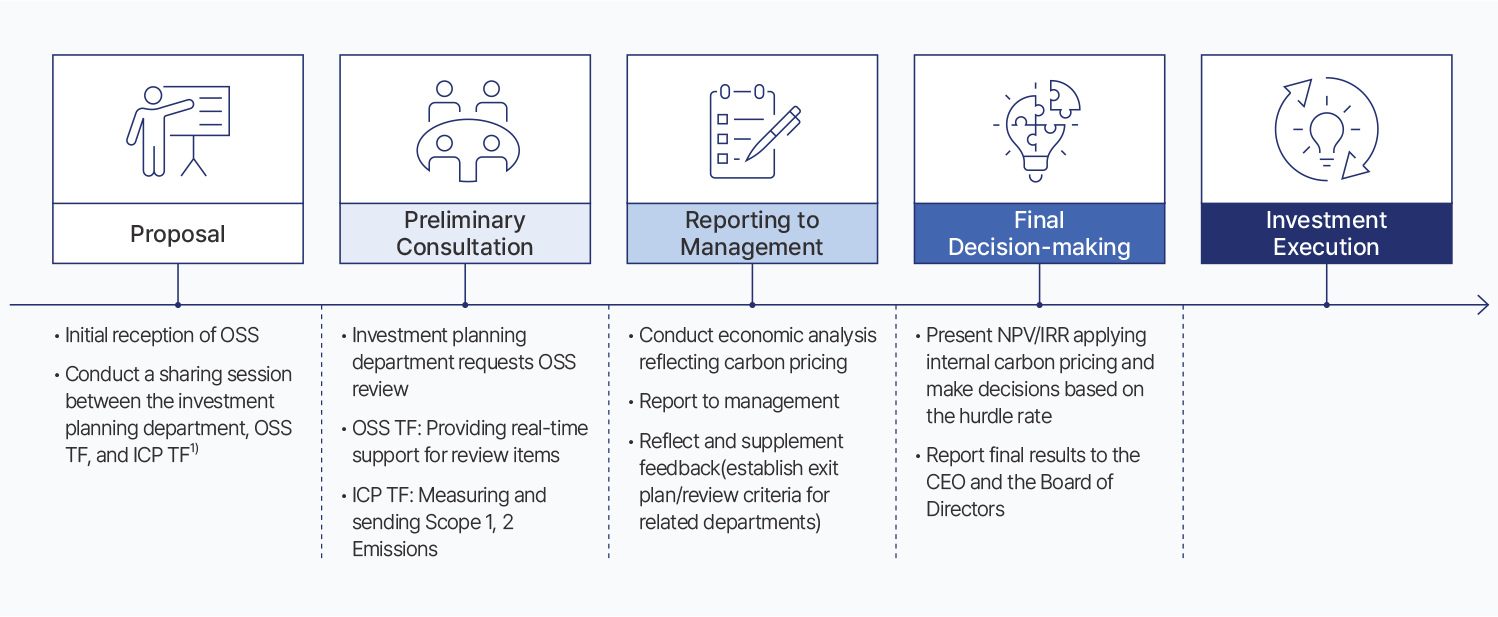

New Business Investment Management

SK Gas operates an OSS* (Opportunity Screening & Selection) process for initial review when investing in new businesses, including existing businesses exceeding KRW 1 billion. The OSS process proceeds through the stages of proposal, preliminary consultation, management reporting, final decision-making, and investment execution. From the business proposal stage, the Investment Planning Department confirms necessary review items through consultation with the Finance RM Group and Strategic Planning Office, which are the OSS lead departments. Furthermore, the OSS leading team conducts reviews of the business according to each organization's function and supports the improvement of the business structure and preliminary risk management. Based on the review results, the Investment Planning Department establishes Exit Plans and reconsideration criteria for each investment/business stage and executes the business through final decision-making.

- *One Stop Support : company-wide support organization Virtual TF for preliminary investment

Internal Carbon Pricing

To effectively implement its Net Zero Solution Provider vision, SK Gas conducts comprehensive economic feasibility assessments that consider carbon pricing when investing in low-carbon businesses. In 2024, the Investment Project Management Regulations were revised to ensure that non-financial factors are considered in investment deliberations, in addition to financial elements. Building upon the existing OSS process, we conduct economic analysis that incorporates internal carbon pricing and reflect the calculated NPV and IRR of the proposed projects in our decision-making.

Investment Review Process Reflecting Internal Carbon Pricing

- 1) Strategy planning, RM, Lab, ESG